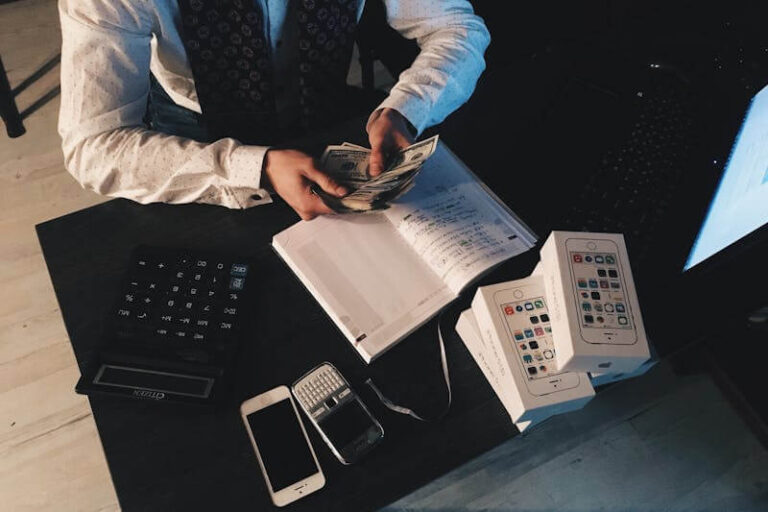

Ever feel like your paycheck disappears faster than your free time? You swear you didn’t spend that much, but your bank balance says otherwise. In today’s economy, where prices creep up while wages hold still, staying on top of your money isn’t just smart it’s survival. In this blog, we will share clear, grounded steps you can take to get real control over your finances without overhauling your life.

Start with What You Actually Spend, Not What You Think You Spend

Most people don’t need a second job they need a second look at their spending. And not in the vague “stop buying lattes” way. That advice made sense when coffee was $2. Now a gallon of milk costs more than an actual gallon of gas. Cutting corners won’t help if you don’t know where the corners are.

Start with the past 60 days of transactions. Track everything. Rent, groceries, impulse takeout, those two streaming services you forgot you still pay for. Get the real numbers. No guesses. Don’t round things up or down. Use your bank’s download feature or a free tracking app. Once you have the data, break it into categories. Needs, wants, and flat-out junk.

Once it’s all laid out, patterns will smack you in the face. Daily charges from apps you didn’t realize were on autopay. Grocery runs that included three “quick treats” totaling $40. Subscriptions billed annually that vanish from memory until they hit like a freight train. You don’t have to stop spending altogether. You just have to start spending like you know what’s coming.

And when you do spend especially when moving money between borders you need tools that don’t lose your money in the process. Whether you’re supporting family, paying overseas freelancers, or managing property abroad, being able to safely send money internationally matters more than ever. Exchange rates shift daily. Fees can wipe out 10% before the money even lands. Using a platform that offers transparency, speed, and real-time tracking puts you back in control. It’s not just about the money reaching its destination. It’s about knowing it got there without being shaved down by surprise costs or delays.

Financial control today means more than watching your bank account. It means understanding how money moves, where it leaks, and what tools protect it.

Stop Organizing by Accounts and Start Organizing by Purpose

Most people think they’re budgeting if they keep their checking and savings separate. But organizing your money by account isn’t the same as organizing it by job. One account can hold multiple purposes, and that’s where things get messy. Rent comes out, groceries go in, a deposit from Venmo shows up, and suddenly your “available balance” is lying to you.

The better approach? Assign every dollar a job before it ever gets spent. This doesn’t mean living on spreadsheets or spreadsheets pretending to be apps. It means defining what your money needs to do before payday even hits. Use your bank’s sub-accounts or envelope-style features. Label them. Rent. Utilities. Emergency. Travel. Fun. Whatever fits your life. Then move your money into those buckets as soon as it lands.

This method, sometimes called zero-based budgeting, forces decisions upfront. You can’t accidentally spend grocery money on impulse shoes if it’s already sitting in a “Food” bucket. You also stop wondering if you can “afford” a weekend trip. If your travel bucket has $200, that’s what you’ve got. Simple. Not restrictive just honest.

And if your current bank doesn’t make that easy? Move. There are no points for loyalty in modern banking. You’re not stuck. You’re paying for service. If the service is bad, find a bank or credit union that respects your effort to organize.

Make Automation Your Assistant, Not Your Boss

Automation is sold as a life-saver, but in personal finance, it works better as an assistant not the one calling the shots. Auto-pay your bills, sure, but not before checking if the amounts make sense. Auto-save for goals, but don’t blindly sweep money into a savings account you’ll raid two days later.

Let automation do the boring work, not the thinking. Schedule weekly check-ins. Ten minutes every Friday to scan your balances, review what came in and out, and adjust if needed. When you stay involved even briefly you catch mistakes. You stop passive spending. You also avoid the autopilot trap where your paycheck vanishes into pre-set transfers that don’t match what’s actually happening in your life anymore.

The idea isn’t to micromanage every penny. It’s to keep a hand on the wheel so the car doesn’t drive into a ditch while you’re distracted.

Rebuild Emergency Funds Like You’re Preparing for a Layoff, Not a Flat Tire

The old advice to save $1,000 for emergencies was decent in 2005. Today, one ER visit, job disruption, or sudden rent hike wipes that out instantly. Emergency funds now have to reflect actual risks like losing half your income overnight or facing three weeks without pay while navigating insurance claims.

Start by setting aside what you can but don’t set the bar so high that you never begin. Even a few hundred dollars can keep you out of debt during a surprise. The point isn’t perfection. It’s momentum. Build it in layers. $500. Then $1,500. Then a month of expenses. Keep it somewhere separate from your checking, but easy to access without penalties. Not in stocks. Not in crypto. Just boring cash in a high-yield savings account that won’t tempt you to touch it unless you absolutely need it.

This isn’t doomsday prepping. It’s giving Future You a fighting chance.

Understand That Control Isn’t a Destination It’s a Habit

You won’t wake up one day and feel completely in control of your money forever. Life shifts. Incomes rise or fall. Needs change. Emergencies pop up. What works this month might not work next year.

That’s fine.

Real control isn’t a number in your bank account. It’s how quickly you can adapt without unraveling. How clearly you can see where your money is going. How confidently you can adjust your habits without spiraling.

Treat your finances like a houseplant. Don’t ignore it. Don’t obsess. Just check in, water it, adjust the sunlight, and it’ll grow. Miss a day? No big deal. Just don’t wait until it’s crispy and brown before noticing again.

In the end, better money control isn’t about having more. It’s about doing better with what you already have. And in this economy, that’s not just smart it’s necessary.